How are we really through a third of the year already?! But we are into the magical bank holiday part of the year and thanks to Her Majesty, we are treated to an additional holiday day this year! April sees yet more records broken with vacancies hitting all-time highs, salaries increasing and continued demand for senior finance professionals.

April saw the continued strong demand for senior finance contractors. Fresh annual budgets renewed, it’s full steam ahead for many of our clients looking at finance transformation projects. Candidates with prior experience implementing finance systems have been in hot demand (NetSuite/Dynamics/SAP – to name a few!). We’ve also been engaged on several assignments looking for technical reporting accountants to support with end-of-year accounts and audit (Ideally candidates possessing experience in both FRS102 and IFRS reporting standards). We are also seeing a trend in clients looking for candidates with good knowledge of financial instruments (IFRS 9, IFRS 15, and IRFS 16).

The newly qualified market has been an area of huge demand this year, with most candidates receiving multiple offers. Salaries have increased because of the lack of demand, and increased competition; Having had conversations with many clients who are struggling to hire in this area. To compete in this market, you must move quickly, be competitive, and sell the opportunity to the candidate. A recent client of mine had 2 failed rounds of recruitment, losing out to other companies. After delving deeper into their recruitment process, we identified a couple of areas for improvement. Firstly, the speed and overall process, cutting down from 3 interviews over 2-3 weeks to 2 interviews in one week. The other improvement was how much time they took to sell the role to the candidate, this time they explained the growth plans for the business, the extra projects they will be involved in, and how the role will develop over the next 12-18 months. We then introduced 3 suitable candidates to the new process, resulting in an offer being made to a candidate (and more importantly it was accepted!).

If you’re struggling to hire, get in touch and I’m happy to give free advice on how to attract and hire top senior finance talent.

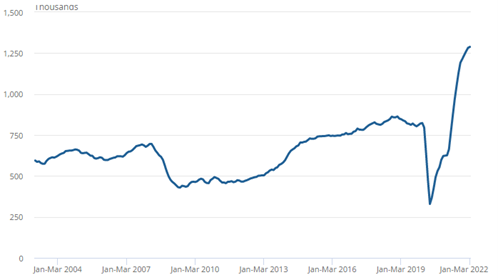

Vacancies have once again surpassed previous records to hit an all-time high of 1,288,000 (Jan-March). Just to put that into perspective that’s almost half a million more than pre-pandemic levels. But the rate at which vacancies are growing is continuing to slow, with quarterly growth now at 4.1%. It’s looking likely the peak may soon be coming, which was always inevitable as this rate of hiring couldn’t continue permanently.

Salaries increased so much over 2021/2022 that Elon Musk has enough money to spend $44B on buying Twitter! But he’s not the only one to get an increase in earnings…The ONS has said early estimates for median wage growth from March 2021 to March 2022 to be 6% (11.2% compared to 2020). Different industries will naturally have higher and lower increases, with Financial Services leading the pack with an increase of 19.7%. We’ve certainly noticed an increase in Senior Finance candidates, the lack of supply and increased demand have pushed salaries up right across the board. As an example, newly qualified ACAs are now seeking (and being offered) between 10-20% higher than they were 12-18 months ago.

Contractoruk.com published that between October 2021 to January 2022 the variance in rates between Outside IR35 and Inside IR35 contracts climbed to just over 24.2%!

April 2021 saw a huge change in policy for contractors – IR35. At the time, there was a lot of speculation about how the changes would affect the contract market. Would companies stop hiring contractors? Would contractors decide to find permanent work instead? Would the rates go up? I’ve caught up with Absolute’s Director of Interim Services, for his take on the changes over the last 12 months!

“With 12 months passing already since the IR35 reform came into effect in the private sector, let’s take a look to see what’s changed. HMRC allowed a “soft landing” during those 12 months where financial penalties wouldn’t be issued for non-compliance. Well, with those 12 months now up, it’s good to know where we all stand, especially as HMRC has already stated that it has begun its IR35 compliance checks!

The HMRC CEST tool has been the centre of debate over the 12 months and, it would seem that it’s still in a state of confusion. The gov.uk website has looked at the recent usage and the CEST tool is giving an “undetermined” result over 20% of the time! According to CEST, Outside determinations are only around 50% of the time. The fact that CEST works off the presumption that MOO (Mutuality of Obligation) exists in all engagements will certainly be affecting these numbers. And let’s remember, there is no option in the CEST tool to say there is no MOO.

On 9th February we saw a report published by the Finance Bill Sub Committee stating there are a number of flaws in the plan for IR35, especially centred around the CEST tool. The CEST Tool cannot and should not be a substitute for law. A 20% “undetermined” rate means a significant number of people need additional support to identify their status if the off payroll working rules apply.

The continued absence of questions on mutuality of obligation within CEST means that many of those impacted by the off payroll working rules do not have confidence in the accuracy of its results.

From the same report, they found 21% of contractors reported a blanket assessment and, 11% were told to move to payroll without an assessment. There are many candidates we speak to, especially those with niche or in demand skill sets that will only consider engagements Outside IR35. With the demand for talent in these areas on the climb, they can most likely hold out for an Outside engagement.

The IR35 reform has certainly had an impact on contractors’ rates, and whilst it’s difficult to work out an exact take home pay due to a number of variables, we do know that as a general rule a contractor will need a 25 to 30% higher rate to achieve the same take home pay as Outside. Contractoruk.com published that between October 2021 to January 2022 the variance in rates between Outside IR35 and Inside IR35 contracts climbed to just over 24.2%!

We have conversations with customers on a daily basis to discuss interim assignments and when asked if they have carried out an IR35 assessment, unfortunately the resounding answer is more often than not a NO. When comparing Inside and Outside IR35 rates, the differences are staggering and when IR35 isn’t discussed in detail, this of course can waste everyone’s time. If only we could rewind to pre IR35 in the private sector, wouldn’t all our lives be much easier. IR35 however is here to stay which is why we spend a great deal of time advising and consulting with our clients and candidates to ensure the engagement is commercially attractive for all parties” – Daryl Riley, Director of Interim Services at Absolute

I’ve said it many times this year but if you’re hiring this year, recruitment processes are key! We are fast approaching Summer which feels odd to be saying. For me, it only seems like yesterday I was trying to zip up my trousers after eating way too much turkey and mince pies at Christmas… Although a summer holiday definitely is in need after the relentlessly busy market so far this year!

Keeping summer in mind, it can be tricky to organise diaries and interviews with hiring managers and candidates on annual leave! If you’re going to be needing to hire over the summer, I would get a jump start on it now as in this market it could end up taking longer than you expect. The beauty of technology has enabled us to “in theory” meet people and move through processes quicker but I’ve seen many fail at this and lose candidates. Having a well-planned and slick recruitment process over the summer could mean you beat the unprepared competition out there!

……With that in mind, I am off to look at summer holidays for the Reeve family 😊

Thank you for taking the time to read our market update. As always, if you would like any advice on hiring, candidates, salary benchmarking or just a general chat about the market, please get in touch.

Senior Qualified Finance Recruiter

Tel: 07949 161 351