May has been a month of highs and lows, as we see record vacancies and companies hiring but at the same time, we hear of uncertainty in certain markets and redundancies.

Boris also managed to keep his job (for the time being) and the Queen celebrated her platinum jubilee!

Interims…Interims…Interims! 2022 has been a really strong year for interims with consistent month-on-month demand for experienced qualified senior finance contractors. The scarcity of such candidates has pushed rates up, with companies paying more to secure a contractor.

This month has shown no signs of the demand slowing, as we’ve been engaged in several critical searches for professional senior finance contractors. The roles have ranged from both management and financial reporting focussed, to system changes and transformation pieces to very technical financial modelling. Soon the summer holiday season will be here, and it’s a good time for companies to hire interims to cover busy periods, with typically lower resources in the team. So if you are a senior finance contractor, do get in touch as no doubt we will have opportunities to speak with you about.

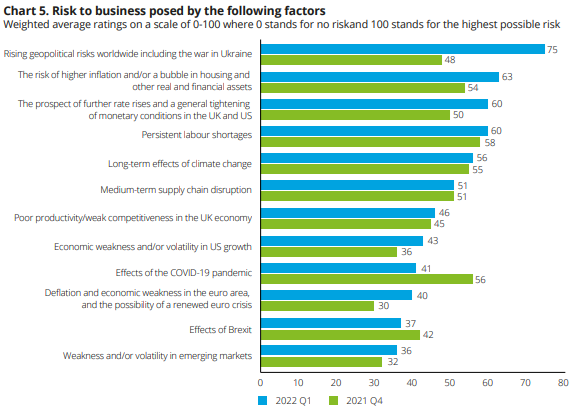

It’s a strange topic to be writing about. On one end of the scale, we have record vacancies and companies hiring in a very competitive candidate market. But there is a feeling of uncertainty in the air for some and the conversations I’ve had this month more than any month so far this year, have been that things may well be on the downturn with talks of a major global recession looming. The cost of living has skyrocketed, and the current economic outlook looks uncertain. Deloitte’s Q1 CFO survey reports the 4 biggest risks to businesses are geopolitical, higher inflation, further rate rises and labour shortages. A shortage in staff, higher costs and geopolitical uncertainties is not giving confidence to some in the market.

For what feels like the first time in a long time, I’m hearing of more and more redundancies. Tech giants including Klarna, and Gorillas have both laid off a number of people globally, and several others have frozen their recruitment plans. I think for many investors, the risk appetite has changed. The growth first at all cost approach, scaling as big and fast as possible is just not sustainable in this current economic climate (or certainly not involving investor’s cash). Burning through money like there’s no tomorrow is not a strategy a lot can get behind. This in turn is having a knock-on effect to companies hiring plans. But this uncertainty has increased the demand for contractors, with some companies hiring on an interim basis whilst they assess the market.

But that’s not to say the investment isn’t out there. I’ve spoken with a company last week who are imminently due to close off a very successful Series B fund raise, enabling the business to launch in a new market which will involve scaling their team.

On the hiring front, it is still incredibly busy and competitive. The ONS reported the UK now has more vacancies than unemployed people for the first time since they began gathering data. Job vacancies are now tipping over 1.3 million and unemployment has dropped to its lowest level since 1974.

Salaries have increased across the board, both permanent and interim but there does seem to be a vast difference between what candidates are being offered in new companies compared to internal pay rises. We’ve seen candidates getting 20%+ pay rises (some as high as 35%) when moving to a new business. In comparison to much smaller pay rises for staying put.

In this market, if you’re not paying the market rate do not expect people to stay long term. Although pay is not always the main motivator for people moving companies, we are living in times of sky-high inflation and with the cost-of-living crisis, candidates will naturally want to make sure they are paid the market rate. I read an article of a company that had a policy when hiring to increase the wages of existing employees (of a similar skill/level) to any new hires to match their salary and in doing so hadn’t lost a single employee since the implementing it last year.

Recruiting senior finance professionals has been a challenge and will continue to be, as I mentioned earlier; there are more vacancies in the UK than unemployed people. That is not going to change overnight. However, I do feel this is slowing down and we are close to the peak. Perhaps in Q3, we will see a minimal increase or even a plateau, and in Q4 2022/Q1 2023 we may well see the first decline in vacancies since the Q2 2020.

There’s still a very strong demand for senior finance candidates, if you’re thinking about moving then I would strongly advise doing so as soon as possible as with potential uncertainty looming, the market next year could be very different.

Thank you for taking the time to read our market update. As always, if you would like any advice on hiring, candidates, salary benchmarking or just a general chat about the market, please get in touch.

Senior Qualified Finance Recruiter

Tel: 07949 161 351