Hello and welcome! 👋 August has been a busy month. This year, the Reeve family opted to stay in the UK for our summer holiday (taking a 2-year-old on a plane just didn’t fill me with joy!), and we were fortunate enough to have picked a good week with the weather. I hope everyone else has had an enjoyable summer.

For my contacts in senior finance looking for roles or hiring themselves, August can often be a frustrating month with interviews stalling, and I spoke with a candidate this week who has been in a process for 8 weeks over the summer.

September is typically a good month for recruitment. We usually see an increase in both candidates looking and the number of roles advertised. So far, it’s looking positive as early signs are indicating an increase in candidates looking and more roles coming to the market compared to the first half of the year.

This week, we had the pleasure of hosting another successful senior finance event in London. More than 40 FDs and CFOs joined us to network with peers and share challenges and ideas!

Key takeaways include:

Another topic of conversation was around salary growth and inflation. Did you know that wage increases have finally caught up with inflation for the first time this year?!

Wages rose by an average of 7.9% across the UK in the three months to June, with inflation still creeping around similar figures. This is proving a tricky environment for CFOs, who are having to try and forecast salary increases across the business during a period when many businesses are looking to shed costs. But something I discussed with a couple of CFOs this month was the impact of losing staff if you didn’t increase salaries.

Discussing the potential implications on the business, how projects would be delivered, and what the impact to customers might be. The burden on existing teams isn’t always considered, and we often hear from candidates about the strain put on them once people leave a business. In dire circumstances, this can really snowball quite quickly, with more deciding to move on.

Longer recruitment processes and a struggle to find good candidates have further fuelled this and made retaining staff even more crucial. Despite all of this, the statistics show that most candidates are more likely to negotiate a higher pay rise when moving roles than staying put.

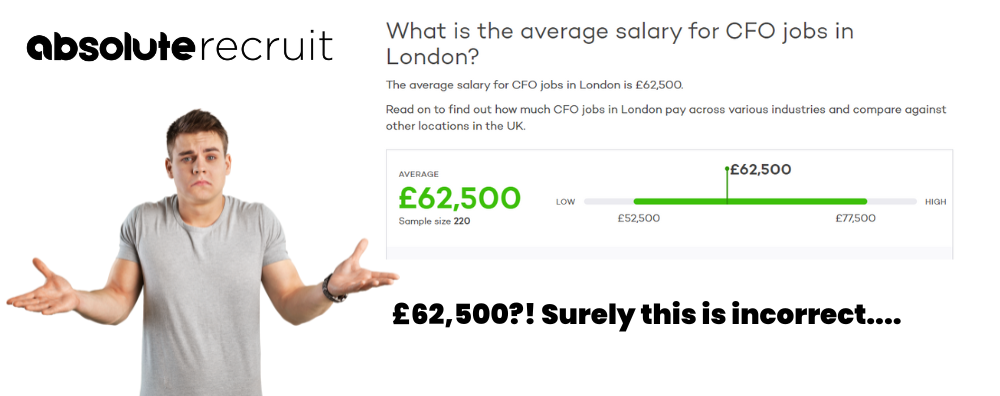

Whilst on the topic of salaries, I was asked about benchmarking tools and my thoughts on them. Did you know the average salary for a CFO in London is £62,500?! Or so the results show on Total Jobs.

Obviously, this is incorrect, but if you ask Glassdoor the same question, it’s £186,327?! When researching, I found multiple sites that were all giving wildly conflicting salaries, so it poses the question if you’re a CFO who is looking to benchmark their salary, who do you go to, and who can you trust?

Online tools can be useful but when it comes to salary, you can’t accurately benchmark it on location and job title alone. You need to consider company size, industry, turnover, ownership (and so many other factors). CFOs looking to target a role in a large, listed business will require a different skillset and experience compared to a CFO in a growing SME. They’re different businesses, with different skills required and different budgets (something not shown on online salary sites).

I’m often asked to benchmark new roles for clients and will say the more specific info I can get, the more accurate I can be with the salary range. Asking the salary of a Financial Controller in London may return an answer of £80,000 – £120,000, which is of no use to anyone. Still, with more information, you can get a far more accurate (and valuable) benchmark.

Don’t get me wrong, online salary data tools can be helpful, but it can be costly to rely solely on these and, as a result, incorrectly benchmark a salary. Getting it wrong as a candidate could mean you pitch yourself too high and price yourself out of a role or too low, and you sell yourself short.

Interestingly, I’ve also seen so many companies benchmark roles too low that result in bad/failed hires or no hire at all in a lot of cases. Alongside looking at online salary tools, I would highly recommend speaking with experienced recruiters in your market. A good consultant will be able to give you a current, accurate view of the market and guide you on salary.

September is typically a good time to be looking for a new role and for companies to hire. Hiring managers and candidates are fresh from holidays, and there should be less risk of interview processes being impacted by annual leave. Our clients have been engaging us on a range of permanent and interim hires across most levels of finance in sectors, including real estate, construction, technology, financial services, and retail, to name a few!

2024 hires! Looking for someone to join your team in January? You need to start the process now. Really, you should have started weeks ago.

Most senior finance candidates are on a 3-month notice period, meaning candidates need to hand their notice in by the end of September in order to start with you in the new year… But our clients are telling us that in a lot of cases, roles are taking them 4+ weeks from advertising to the offer stage.

For more niche skill sets, it’s 8+ weeks. If you’re relying solely on direct advertising and internal talent teams, my advice would be to move very quickly and advertise the role immediately. Be extremely flexible with your requirements to widen the pool of talent and make sure you are offering an attractive salary and benefits package. If, like many, time is crucial, and you need to ensure the role is filled quickly without compromising on quality, then I would suggest engaging with an agency.

A good recruitment agency will be able to put in the resources to find suitable candidates quickly and can act as a first-stage interview. The significant benefits are speed and quality so that you have the ideal candidate starting on time (don’t forget what I mentioned before about the impact on businesses).

A recent example of this was a client we worked with who urgently needed to find a candidate to replace a soon-to-be departing Head of Finance. The client had already recruited a replacement directly, with enough time for a handover to take place. Unfortunately, the candidate backed out the week before starting, which left the client with little to no time to find a replacement and to ensure a handover happens before the current incumbent left. The impact on the team and business was huge if he couldn’t secure a candidate quickly.

We worked closely with the client and allocated additional resources to ensure we packed in almost two weeks’ worth of resourcing and candidate interviews into about three days of work. We presented a shortlist to the client and managed two further interview stages, which resulted in an offer being made (and, more importantly, accepted) and a handover with the soon-to-be exiting Head of Finance.

Hiring directly can save money, but niche or urgent roles may require external support. Sometimes, the impact to a business of not hiring quickly enough or a bad hire can be more costly than paying an agency a fee. For anyone interested in finding out how we can support you, please get in touch.

Thank you for taking the time to read our senior finance market update. As always, if you would like any advice on hiring, candidates, salary benchmarking, or a general chat about the market or to discuss your next role, you can now book a 30-minute call with me using this link – https://calendly.com/ashley-absolute-recruit/30min