I hope you’ve all had an amazing break over the festive period. I’m back and ready to kick off 2023 after spending Christmas with the family and was fortunate to celebrate new year in Wales (a beautiful country).

2022 seemed to fly by, and what a year it has been full of ups and downs! Last year saw record breaking vacancy numbers, and one of the strongest markets for senior finance candidates (the demand was crazy). It also sadly saw the passing of Her Majesty, and one or two budgets (like we need reminding about those!), and I certainly can’t leave out Absolute Recruit’s rather snazzy new re-brand!

Before I kick off 2023, here’s a quick re-cap on what 2022 delivered….

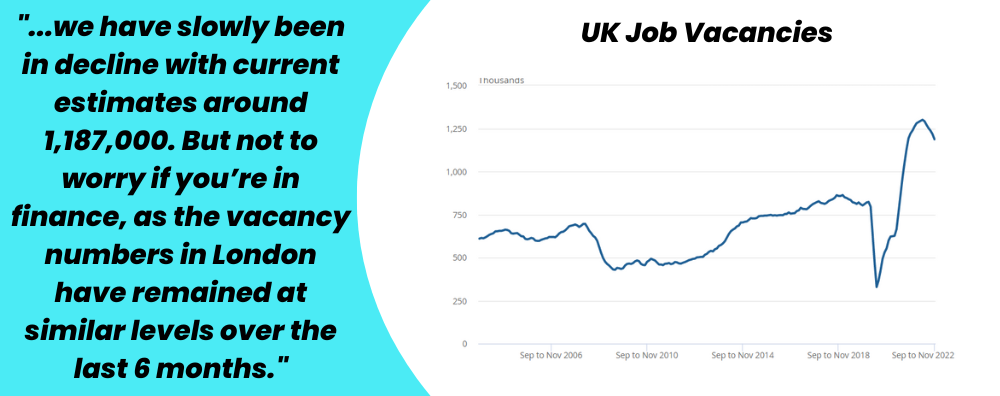

After 2 years of record-breaking growth, the vacancies finally peaked around May last year at an all-time high of 1.3m! Since then we have slowly been in decline with current estimates around 1,187,000. But not to worry if you’re in finance and considering making a move, as the vacancy numbers in London have remained at similar levels over the last 6 months.

A report from Atomico suggests European start-ups have raised £15bn less in 2022. From speaking with our VC investor network, it’s clear there was significantly less of an appetite for risk and this looks likely to remain in 2023. Firms are cautious, and want to see there is traction and demand for the product/service. We’ve seen that firms seem to be investing in less start-ups but more capital into the investments they are making, to give them a long-run rate to see them through the recession. We’ve supported many start-up Founders with fundraising, introducing portfolio CFOs experienced in dealing with investors and providing the forecasting and financial due diligence.

Almost 75% of our candidates were not actively looking for roles. No CV on job boards and were not actively applying for roles. If you are solely relying on job adverts to secure candidates in the market you are missing a huge opportunity to tap into the passive candidate market. If you have been struggling to fill a position, I would highly recommend speaking with an experienced agency who can support with this.

During the boom of 2022, the demand for skilled senior finance candidates spiked and far outweighed the supply of candidates available. This led to many companies offering above-market rates, pushing salaries up. Competition between companies for the best candidates and counter offers from their existing employers further fuelled these salary increases.

The ONS reported that the average regular pay growth was 6.9% from August 2022 to October 2022, although this is actually a 2.7% fall in earnings when adjusted for inflation. Candidates are concerned with rising costs, and no doubt their pay increases (or lack of) may be on their minds. To put it into perspective, anything less than a 10% pay rise will be a fall in income for employees.

Although 2023 may not quite continue at the same pace as last year, the current supply of candidates is still far too short to contend with the demand. Keeping this in mind, it won’t be surprising to see senior finance candidates looking for new opportunities if their earnings drop.

January can often be a time for new year salary reviews for the team, something I am already supporting with my current clients. As a new year gift, for anyone reviewing salaries in Q1 I am offering a free salary review for finance teams, please click below to book a 30 min call

My 2023 salary prediction is that they will increase in line with 2022, driven by high inflation and the continued demand for senior finance talent in 2023. Although UK salaries rose by 6-7%, many of our candidates were in such great demand that when moving companies, they saw salary increases of 10-20%.

We’ve seen a strong demand in senior leadership roles, with clients looking for candidates that can demonstrate previous experience implementing change and cost-saving strategies. Candidates that have a proven track record of leading through difficult times are highly sought after. One recent example of this are finance leaders who have successfully led transformation projects on struggling companies during the pandemic, with great results!

Many of our start-up clients have been seeking candidates with experience in fundraising (Seed-Series C). Key required experience spans assisting with pitch decks, financial due diligence, forecasting and communicating with potential investors. Typically, we are seeing a lot of interest from seed stage through to Series A, with many Founders looking to bring on their first finance hires who can support their investment activity. Naturally, due to fund limitations, we are seeing an interest in portfolio CFOs who can help on a part-time basis until funding is secured.

December saw the continued growth of contractor vacancies. Many clients were looking for technical accountants to support them with year-end accounts and audit preparation work. Others are seeking interim support for budgeting and forecasting work heading into 2023. Unfortunately, with is a shortage of available contractors; clients are having to increase rates to compete for skilled candidates. Professional contractors will usually be well-networked with agencies; and are typically on and off the market in days.

When speaking with hundreds of clients and candidates every year, it gives me valuable insight into trends and changes within the industry. This can be trends in salaries, roles and what skillsets are in high demand. I’m often asked, what are popular systems? In my last update, I asked various start-ups what systems they were currently using, and with the demand for FP&A professionals now increasing, this time I asked “what are the most popular FP&A systems at the moment, and why?”

A 2022 report from The Finance Market Research rated DataRails at the top of the list with Jedox coming in second place and Anaplan in third

Interestingly, the poll I ran came up with a slightly different result. Anaplan topped the score sheets with DataRails coming in second! Having gotten this result, I did some research myself on Anaplan and saw some promising reviews – example below:

All three companies had great reviews, so my advice for anyone looking at FP&A software is to go check them out.

The current economic climate will have companies focussed on implementing cost-cutting measures. Candidates that can display prior experience in leading cost-saving projects across businesses will be in demand. While employee salaries are typically one of the largest costs for companies and cutting headcount can be a quick way to lower costs, many CFO surveys suggest the downturn and recession aren’t expected to last far beyond 2023 some even suggesting growth again late this year. During the pandemic, many companies made mass redundancies only to then struggle to re-hire again as the market picked back up. Many of our senior finance candidates have shown versatility, able to work with other departments to reduce costs across various areas including software licences, subscription costs and renegotiating with suppliers. A strong finance leader will have the ability to get the rest of the business on board with the cost-saving projects, with the ultimate goal of reducing spend without having to reduce headcount (where possible).

FP&A candidates will have a busy year this year, planning ahead with budgets and forecasts. In this market, scenario planning and financial modelling will be key skill sets in order for companies to plan for many eventualities. Candidates with strong communication skills will be highly sought after, particularly those who are able to influence non-finance colleagues and really get them on board when it comes to budgets.

Candidates with transformation project experience should do well in 2023. I’ve heard lots of businesses are looking to drive efficiencies within teams and in finance, this includes automation projects and implementing new systems and technologies. Microsoft has tripled their revenue since 2008 but has kept its finance team’s headcount at a similar level by driving efficiencies in the team through automation and investing in financial tech.

Last year the senior contractor market grew rapidly, with demand far outweighing supply leading to rates increasing and companies struggling to hire. I think the 2023 market will further fuel this, with many companies opting to hire contractors rather than permanent hires until they see how the year progresses.

As I mentioned above, 75% of the roles we filled came from passive or non-active candidates. Due to the recession and the need for senior finance candidates to support businesses this year, I only see continued demand and difficulty when hiring. Being able to tap into the passive and non-active candidate market will be crucial for businesses as they compete for talent this year.

Thank you for taking the time to read our senior finance market update. As always, if you would like any advice on hiring, candidates, salary benchmarking or a general chat about the market or to discuss your next role; you can book a 30-minute call with me here: