Welcome everyone! I know February is the shortest month of year, but these months seem to be zooming by at the moment! It only seemed like last week since I was writing my last update to you all! March is here, the final month of Q1 which will see accountants busy with year end and perhaps new measures to consider from the Chancellor’s budget update this month….but the good news (for me) is the F1 is back on 😊

February has been an interesting month, companies are being cautious with hiring plans and even the fastest-scaling companies are reigning in the growth plans for a more reserved and considered approach. I’m also hearing of more redundancies in particularly volatile markets and we have noticed more candidates coming to the market than compared to any time in the last year.

Looking to hire now? This may be one of the best times to take advantage with less competition and more candidates compared to any time in the last 12+ months.

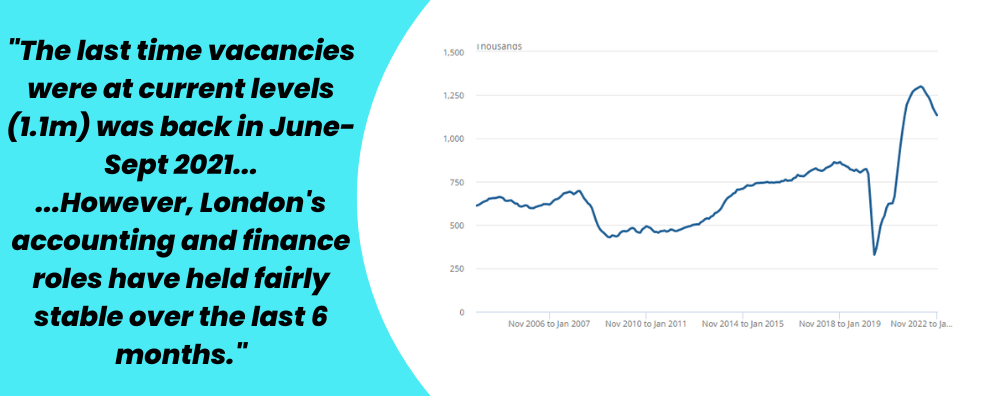

UK Vacancies have fallen further to 1.1m, the last time we saw similar levels was Q3 in 2021…but if you read last month’s update you’ll know that despite UK vacancies falling, London’s accountancy and finance roles have held fairly stable over the last 6 months.

As I mentioned earlier, it’s a great time to hire – more so than any time in the last 2 years. Our data is showing that we are receiving 3.5 times the amount of candidates contacting us to register their details for new roles compared the Q4 last year. Job applications to our adverts are also up compared to 2022, meaning there are more candidates coming onto the market. Despite vacancies dropping, there is still a lot of choice for London-based accounting and finance professionals.

More applications sound great for companies looking to hire…BUT we’ve spoken with several clients this month who are struggling to manage recruitment processes. Receiving hundreds of applications isn’t manageable for hiring managers having to review CVs and select which candidates to invite for initial screening. These processes can take days and weeks which can be frustrating and time-consuming, even more so if you still don’t manage to secure a candidate at the end of it.

Time-to-hire can be extremely important for businesses. It’s not just a figure for a spreadsheet or HR teams to measure, companies need to consider what impact this can have on existing teams and the wider business. I recently read a report that noted the average time to hire within Accountancy & Finance is 29 days. When considering notice periods (typically up to 3 months) can mean you are waiting more than 4 months for a candidate to start. With the current economic climate, working with external agencies may seem like an unnecessary expense until you have at least tried to hire yourself, but engaging agencies early can significantly reduce your time to hire. As an example, our average time to hire is 12 days, so it can pay to use an agency to help reduce the impact to the business.

It wasn’t too long ago that Artificial Intelligence felt like something that was still decades away from impacting our day-to-day lives (I’m thinking Will Smith running around chasing robots who were trying to take over the world) But AI has taken leaps and bounds in the last few years, most notably with the release of Chat GPT which has made huge waves across the world and made a huge positive impact on the way people work, and honestly I wish Chat GPT had been around when I had homework to do!

Artificial Intelligence is now transforming the world we live in, and finance and accounting is no exception. But is that a good or bad thing for accounting and finance professionals?

An article from the ICAEW asked Richard Anning (Head of ICAEW’s IT Faculty) “Will AI reduce the need for accountants?”

He responded “ I think the answer is probably yes,”

But don’t start looking at retraining just yet! Richard goes on to explain “But you have to define what an accountant is. If you’re looking at some of the more repetitive bookkeeping or process-driven tasks, those are more likely to be subject to automation than the higher value task,”

AI isn’t going to replace all accounting and finance roles, but it looks likely to automate a lot of mundane and repetitive tasks and providing valuable insights into complex financial data.

Michael Whitmire, CEO and Co-Founder of FloQast, also agrees with this sentiment: “Accounting departments overall will be trimmed down and the employees left will be able to focus on more strategic initiatives, like process improvement, cost control, and capital optimisation. AI is already beginning to automate tedious tasks such as data entry. Automation is occurring at the staff level, but it will creep up the corporate ladder and begin to automate higher level accounting jobs,”

Don’t worry just yet, robots aren’t here to take your jobs. In fact, if used correctly AI looks set to transform the way finance teams work.

Here are some examples of how our senior finance contacts have been working with Founders to utilise AI:

Automating Repetitive Tasks

One of the biggest benefits of AI for accountants and finance professionals is its ability to automate repetitive tasks. This can include transactional finance tasks such as data entry, invoice processing, and reconciliations. By automating these tasks, AI can help accountants save time and reduce errors, freeing up valuable time to focus on more strategic and value-added work.

Providing Valuable Insights

This can include analysing financial statements and data to assist in predicting future trends and identifying errors. By providing these insights, accountants can make better decisions, improving financial performance and efficiency.

Fraud Detection

Fraud is a major risk for all businesses regardless of size and industry. AI can help to automate the processes of detecting fraudulent activity more quickly and accurately, saving accounting and finance professionals time.

Analytics/Predicting Trends

By analysing historical data, AI can help predict future trends and identify potential risks. This can help companies make better decisions and improve their financial performance.

We’ve seen an increased demand in the last 12 months for finance professionals with experience in designing and automating processes. Finance candidates that can utilise new technology to improve errors and efficiencies within businesses are highly sought after.

Automation projects

As I mentioned, there has been a steady increase in companies looking to save costs, reduce headcount and be as efficient as possible. We’ve had clients looking for finance candidates that can demonstrate the ability to come in map out processes and drive efficiencies within the business, often utilising new technologies such as AI, particularly those who can utilise technologies involving AI and automation.

Financial Modellers

It doesn’t always have to be fancy new software though, individuals with strong financial analysis and modelling experience that are able to work with and build models from existing data to provide new insights are also highly sought after. I recently worked with a client who was looking for ways to make improvements within the team, making the finance function and other departments run more efficiently. I introduced a financial modeller who automated their month-end reporting and processes and reduced their month-end close from 12 days to 3. The impact this had to the business was huge as the board had greater visibility far earlier in the month.

Fundraising

It’s no secret that the appetite for investment has drastically dropped since 2021-2022 levels. Investors are being cautious with the deployment of funds and companies now have even more competition when fundraising. We’ve been speaking with pre-seed and Series A Founders recently looking to raise investment and have made introductions to portfolio CFOs who have the knowledge and expertise (and connections!) to put the company in the best position before fundraising. This can be through putting in place financial controls and processes, building out reporting packs, providing financial forecasting and due diligence, and helping with pitch decks and investor meetings. For investors, seeing a business has a strong finance leader already in place certainly gives confidence that funds will be managed appropriately.

Last year 61 companies took part in a nationwide, four-day work week pilot scheme and if you haven’t already seen the results they are pretty astounding!

92% of the participating companies are continuing with a four-day work week. Why might you ask?

Improvements in Mental Health and Well-Being

Reports show anxiety, fatigue and sleep issues all significantly reduce as employees’ work-life balance increases:

And what were the results for the company for having these less stressed and happier employees?

What about the company results I hear you ask?

Clearly, the benefits of a four-day-work week were more important than money with 15% of employees saying no amount of money would tempt them back to a five-day work week.

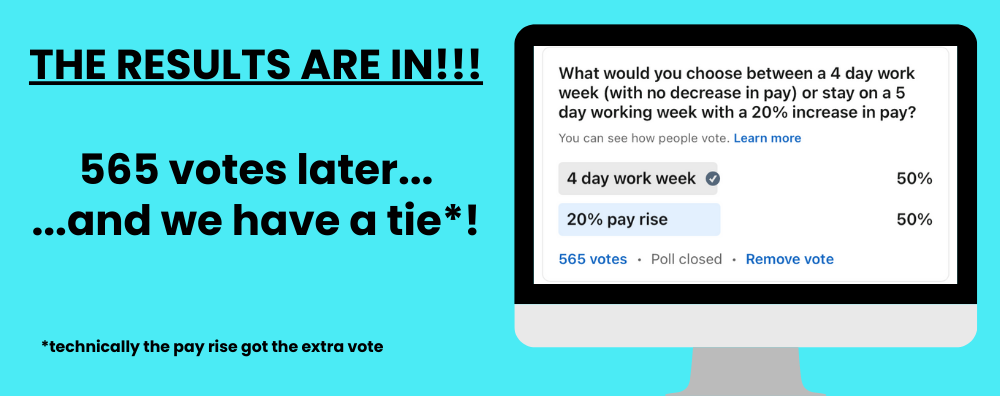

Intrigued by this I asked my LinkedIn contacts what would you choose a 4 day work week (with no reduction in pay) or a 20% pay increase (staying on a 5 day work week). If I’m honest, given the current cost-of-living crisis I thought the pay rise was going to be a clear winner but after 548 votes, the result were a 50/50 tie. Despite living costs at an all-time high, half of voters still favoured a better work-life balance with a 4 day work week over an inflation-busting 20% pay increase. Employers take note! I know not everyone can implement this but employees are valuing work-life balance.

Thank you for taking the time to read our senior finance market update. As always, if you would like any advice on hiring, candidates, salary benchmarking or a general chat about the market or to discuss your next role; you can now book a 30-minute call with me using this link – https://calendly.com/ashley-absolute-recruit/30min