Welcome to March’s market update! A month where we have seen continuing soaring costs, falling vacancies and a perpetual struggle to attract top senior finance talent. There was also another budget to write about ☹ but it’s not all bad news, the clocks went forward, we’ve just had a nice long weekend break over easter and there are 3 more bank holidays coming up in May!

On the 15th March, the Chancellor Jeremy Hunt delivered the Spring Budget. After the turmoil of Kwasi Karteng’s 2022 budget, this was (as expected) a rather muted affair to keep the market calm. I appreciate after almost a month, most have already seen the updates including pension changes and as a parent to two boys, a very welcome extension of free childcare (phased in over the next couple of years).

In a world of ever-increasing costs, it’s important for businesses to capitalise on any allowances available and I want to highlight the end of the super deduction (130%) which expired on 31st March 2023. BUT, the Chancellor did announce the super deduction will be replaced by a “full expensing” scheme, this will run from April 2023 until the end of March 2026).This allows companies who are liable for corporation tax, to benefit from 100% first-year allowance for capital expenditure (potentially reducing tax payable, by 25p for every £1 that has been invested in eligible plant and machinery).

Implementing the right ERP system can be a game-changer, providing you with robust financial management capabilities, improved visibility into financial data and enhanced reporting and analysis. However, a failed implementation can cause a world of headache, and it’s best practice to approach the process with careful planning and consideration to ensure a successful outcome.

The first major step is defining your organisations objectives, the second is considering which system meets those needs, considering factors such as scalability, ease of use, integrations with existing systems and ongoing support. Once these key decisions are made, here are some important factors to consider when implementing a Finance ERP system:

Common Issues Faced when Implementing a Finance ERP System:

A failed implementation is costly. So we have been recommending ERP project managers, who have the expertise to ensure a smooth transition (recent introductions have been made for Netsuite and Microsoft Dynamics implementation project managers with the former being extremely popular). If you’re interested in speaking with project managers for any system changes this year, please do get in touch.

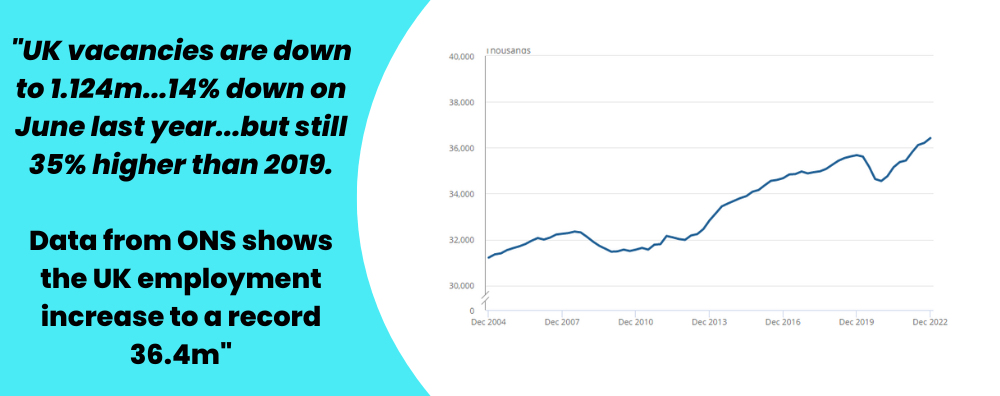

UK Vacancies are down to 1.124m (162,000 less than 12 months ago and 14% down on the 1.3m peak in June 2022). While vacancies are continuing to fall, there are still over 35% more vacancies than pre-pandemic levels. Despite vacancies falling for an 8th consecutive month, companies are still hiring on an unprecedented level – and data from the ONS shows the UK employment increase to a record 36.4m compared with 35.6m pre-pandemic.

Q1 was a much slower start to the year compared to 2022, but we are still seeing a strong demand for senior finance talent across the board. The start-up market dipped at the beginning of the year, the market grew very quickly in 2021-2022 and we’ve seen a correction this year, fundraising has become harder to come by and has meant growth plans have halted and been scaled back, unfortunately leading to redundancies. The positive news for candidate within the start-up space are that we are beginning to see signs of the market improving and companies hiring again as we head into Q2. SMEs have had a more positive Q1 with a strong demand for system changes as I mentioned previously and our larger corporate clients are still seeking senior finance candidates to lead on transformation projects.

More and more conversations recently have come up from our Finance and Compliance contacts within Fintech and Financial Services firms around the introduction of new consumer duty regulations.

Consumer Duty Regulations are a set of rules and guidelines introduced by regulatory bodies to ensure that financial institutions act in the best interest of their customers and prioritise their needs. The aim is to increase transparency, fairness, and accountability and to protect consumers and promote trust and confidence in the financial services sector. The new Consumer Duty Regulations introduce several key changes such as duty to act in the best interest of the consumer, duty of care, disclosure and remedy. Many CFOs I speak with also oversee compliance and risk, so I have outlined how finance and compliance teams could be impacted by the changes.

Compliance Obligations: Compliance teams will need to ensure that the organisation’s policies, procedures, and practices are aligned with the new regulations. This includes reviewing and updating internal controls, documentation, and disclosure practices to ensure compliance with the duty of care, duty of disclosure, and duty to remedy requirements.

Enhanced Due Diligence: Finance teams may need to conduct more thorough due diligence on customers to ensure that financial products and services are suitable for their needs. This may involve collecting additional information, assessing risks, and documenting the decision-making process to demonstrate compliance with the duty to act in the best interest of the consumer.

Training and Education: Both finance and compliance teams will need to undergo training and education programs to ensure they are aware of the new regulations and understand their implications. This may involve staying updated with regulatory developments, attending workshops or seminars, and obtaining relevant certifications to demonstrate competence and compliance.

Customer Communication: Finance and compliance teams may need to work closely with customer-facing teams to ensure that customers are provided with clear, transparent, and timely information about financial products and services. This may involve reviewing and updating customer communications such as disclosure documents, product information sheets, and customer agreements, to align with the duty of disclosure requirements.

Over the last several weeks, we’ve been speaking with clients in the Fintech and Financial Services sector around introducing specialist interim consultants who specialise in setting up frameworks, policies and procedures to ensure businesses are set up and ready for the changes. If you are interested in speaking with these consultants to see how they can support you and your business, please get in touch.

Discussions this month with our larger enterprise clients have been around consulting and planning ahead of the introduction of Pillar 2.

Pillar 2 is a global agreement, to bring rules into law to establish a global minimum tax regime. These rules will apply to both public and privately held multi-national groups with consolidated revenue of over €750m. The EU has released a draft directive requiring EU member states to introduce the rules by 31st December 2023 and the UK have released draft legislation to introduce rules into law in Finance Bill 2022/2023, applying to accounting periods commencing on or after 31st December 2023.

If you’re a company that falls within the scope of minimum tax, feel free to get in touch for introductions to specialist tax consultants that can support ahead of the changes alter in the year.

Key senior finance hires and key areas of opportunity ahead

System implementation project managers

As I mentioned earlier, one of the common conversations this month with our clients (particularly SMEs) has been around system implementations. A key area sought after to improve and enhance reporting capabilities and improve decision-making. This month we’ve introduced several specialists to businesses looking to implement Netsuite and Microsoft Dynamics. Businesses often look for two types of support, a project manager able to oversee the whole project and technical implementation specialists who will be implementing the system.

Fundraising

The market for start-ups looking to raise capital has become more challenging than ever in 2023. VC investment is massively down on 2021/2022 and the market is super competitive with companies all battling for VC’s cash. Senior finance candidates we’ve introduced recently with financial modelling and forecasting experience have proven invaluable to start-ups supporting with due diligence work ahead of a fundraise. Feedback has shown that having an experienced and credible accountant in the business when fundraising, can give VCs confidence that funds will be managed appropriately.

Fractional CFOs

Something we are seeing and hearing more and more of is the rise of the fractional CFO (part time/portfolio). Especially within the start-up and SME space, not all businesses can afford or actually need a full-time CFO but having a CFO on board for even 1 day a week can have such an impact, and as the business scales it gives the flexibility to increase their time in the business.

Thank you for taking the time to read our senior finance market update. As always, if you would like any advice on hiring, candidates, salary benchmarking or a general chat about the market or to discuss your next role; you can now book a 30-minute call with me using this link – https://calendly.com/ashley-absolute-recruit/30min