Welcome to May’s update 👋 Bank holidays galore! Although from speaking with many of you, 3 bank holidays, half term and month-end has proven a challenging time! Despite hiring figures having dropped, coming across good finance professionals in London is still a challenge and competition is fierce. It’s not all bad though…I was privileged in joining three of my colleagues at Absolute Recruit on a trip to attend the Monaco Grand Prix (as a Massive F1 fan this was such an incredible weekend).

Here’s a photo of the four of us at the race for anyone who’s interested!

This month’s update is focussing on the newly qualified market; whether you’ve recently qualified and are considering your next move, or you are considering hiring a newly qualified accountant for your team. You’ll want to read on as I discuss pro’s and con’s, best practices for attracting candidates and salaries/benefits.

As a qualified accountant in London, you have a wealth of career opportunities available to you. A question I am often asked by candidates, and an important decision you may face is whether to join a start-up or a larger corporate business?

Each option offers distinct advantages and drawbacks. After recruiting for both over the years, I thought it may be helpful (for candidates currently trying to make this decision) to see the key pros and cons of joining a start-up versus a larger corporate business.

Pros:

Cons:

Pros:

Cons:

What I will say is that there are certainly exceptions to the above and both certainly have their pro’s and cons and the majority of the time it will come down to personal preferences. If you are considering whether to join a start-up or corporate business, feel free to book in a call with me and I’ll happily discuss and offer any advice I can.

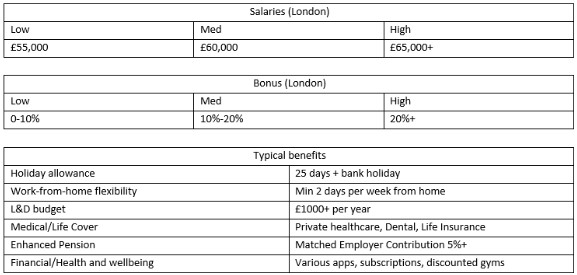

The post-pandemic demand for newly qualified accountants in London has far exceeded the supply and has resulted in salaries increasing. Pre-pandemic, companies would secure newly qualified accountants with a package in the region of £50,000-£55,000. Three years later and you could be needing at least 20% more to attract and compete in this market. I’ve detailed below salaries, bonus and benefits to attract newly qualified ACCA or ACA candidates.

What do newly qualified accountants look for in an opportunity?

After discussing the differences in choice for newly qualified accountants moving into industry, I thought it would be beneficial (for companies hiring newly qualified accountants) to better understand what candidates are looking for in such an opportunity.

Continued Professional Development:

Newly qualified accountants are eager to continue their professional development and build on their existing skills. They seek employers who are committed to investing in their growth and provide opportunities for ongoing training and development. This can include access to workshops, seminars, conferences, and certifications that enable them to stay updated on industry trends, regulations, and best practices. Demonstrating a commitment to their continued learning can attract highly motivated candidates.

Mentoring from an Experienced Finance Director:

Newly qualified accountants often value guidance and mentorship from experienced professionals, such as a seasoned Finance Director. They appreciate the opportunity to learn from someone with a wealth of knowledge and industry expertise. Providing a mentorship program or assigning them a mentor within the business can be an attractive proposition. A mentor can offer career guidance, share practical insights, and support their professional growth, fostering a sense of belonging and investment in the company. As a hiring manager, consider how much time you will allocate to mentoring a new hire as this will impact employee retention.

Growth and Progression Opportunities:

Ambitious newly qualified accountants seek roles that offer clear growth and progression opportunities. They want to work for companies that recognise and reward their talent and provide a clear career path. These opportunities may include promotions, increased responsibilities, exposure to different departments or projects, and the chance to develop managerial or leadership skills. Clearly outlining the growth trajectory within the business can motivate candidates to choose your company over others.

Challenging and Varied Work:

Newly qualified accountants are eager to apply their knowledge and skills to real-world scenarios. They seek roles that offer challenging and varied work, allowing them to gain practical experience across different areas of accounting and finance. Providing opportunities to work on complex projects, engage with cross-functional teams, and handle diverse financial tasks can attract candidates who are driven by intellectual stimulation and professional growth.

Supportive Work Environment:

A supportive work environment is crucial for attracting and retaining newly qualified accountants. They appreciate a positive culture that encourages collaboration, teamwork, and open communication. Highlighting your company’s commitment to work-life balance, employee well-being initiatives, and a respectful and inclusive workplace can make your organisation more appealing to candidates. Emphasising a supportive team structure and a culture of learning and development can create an environment where newly qualified accountants can thrive.

Exposure to Senior Management and Decision-Making:

Newly qualified accountants often aspire to work closely with senior management and be involved in important decision-making processes. They seek opportunities to contribute to strategic discussions, provide financial insights, and have their opinions valued. Offering exposure to senior leaders, involving them in meaningful projects, and creating a culture that encourages their participation can make your company an attractive choice for ambitious candidates.

It’s interesting that quite often when speaking with newly qualified accountants, salary and benefits are rarely at the top of the requirements pile. By showcasing these elements in your recruitment process, you can attract highly motivated and ambitious accountants who are eager to contribute their skills and drive your organisation forward (and importantly retain them as they’ll be happy in their role!).

Start-ups

When recruiting for start-ups one of the key requirements is adaptability. Being able to demonstrate the ability to work in a fast-paced and ever-changing environment. One client of mine recently said “I’m looking for a candidate who can put structure into the unstructured”….I loved the honesty! 😊 When there are little to no processes in place, transformational finance experience is huge! Being able to explain examples of process and system improvement projects and working across multiple projects simultaneously is essential. If this sounds like you, please do reach out as we are working with several start-ups who are looking to hire Management Accountants, Finance Managers/Controllers and FP&A Analysts.

ACA Newly Quals from Practice

This has not changed. Continuing from last month, we still have a huge demand from clients looking for newly qualified ACA accountants looking to make their first move from practice. As I wrote about earlier in this article, if you’ve been considering between start-ups or a larger corporate business we have clients spanning nearly every sector start-up and large listed businesses across Tech, SaaS, Fintech, Crypto, Sports, Music, Retail, Real Estate and FS (to name a few). Salaries in the region of £55,000 – £65,000 + bonus/shares and other benefits. If you’re considering you’re first move into industry, get in touch with me.

Finance Contractors

Again, an area that has not slowed down is the demand for experienced financial contractors. From management reporting, system implementation specialists, financial modelling and maternity cover, it’s been a busy time for financial contractors. There’s a clear lack of immediately available candidates in the market, particularly since the IR35 changes but if you are an experience contractor, please do get in touch with us and register as we regularly have clients that offer work outside of IR35 due to the scope of work, and/or the small size of the business (start-ups).

Thank you for taking the time to read our senior finance market update. As always, if you would like any advice on hiring, candidates, salary benchmarking or a general chat about the market or to discuss your next role; you can now book a 30-minute call with me using this link – https://calendly.com/ashley-absolute-recruit/30min