November is over and we now head into the final month of the year. A year that for me has absolutely flown by, it only seems like yesterday I was red as a lobster after my holiday to Majorca in July and now we’ve just put our Christmas tree up. I can’t take any glory for how our tree looks, it was all down to Mrs Reeve’s decorating skills. Honestly though, how is it Christmas this month?! I’m digressing, back to business – November has seen huge changes from the Government which will inevitably impact employees and businesses further in addition to high inflation rates. Everyone is bracing for a tough 2023 as the market declines but interestingly the talent market remains challenging and candidate driven.

Last month saw a continued trend since September in the demand for Commercial Finance, Finance Business Partners and FP&A Analysts – needed to support companies on a range of projects next year from financial modelling, system integration and process improvements in relation to budgeting and forecasting work for next year. There is not much change on this in November with these candidates remaining in high demand, leading on cash flow management and cost saving projects for clients.

Recently we’ve also noticed many clients looking to move into new jurisdictions. Some businesses are taking the opportunity to expand into new markets, which has led to an increased number of our clients asking us to find senior finance candidates with specific international and tax knowledge, with IFRS and US GAAP (SOX too) being the most sought after.

Despite a downturn in funding compared to last year, we are working with several pre-seed and Series-A startups who have recently secured funding and are full steam ahead with their hiring plans. Start-up Founders in particular are looking for strong leadership qualities when building out their senior management team, but candidates interested in these positions will need to demonstrate flexibility; and be prepared to be very hands-on initially until the team scales. Several Founders we are speaking with are also keen to speak with portfolio CFOs who could help with fundraising, financial modelling, forecasting and business plans.

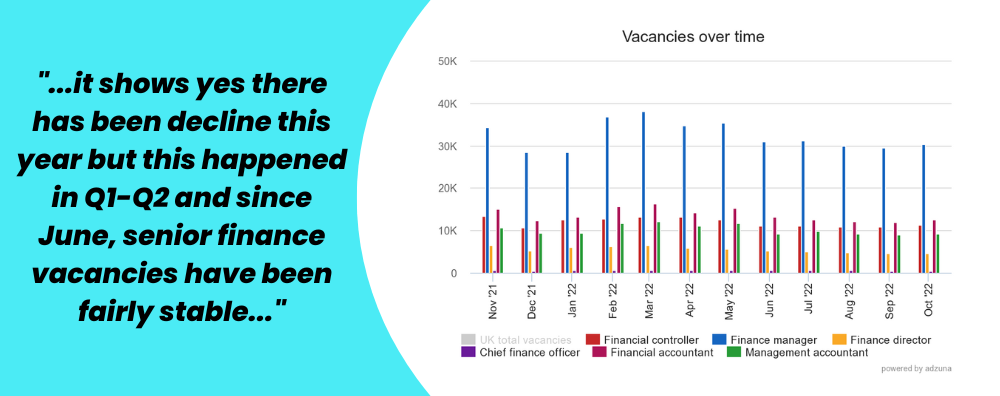

The current job market is in decline, let’s not hide from that fact, but interestingly the senior finance job market has held steady over the last 5 months. Looking at data from Adzuna (who gather data from most UK job boards), we see that while yes there has been decline this year, this has mostly occurred in Q1-Q2. Since June, senior finance vacancies have been fairly stable. Finance Manager is the title with the most amount of adverts, not surprising because it can be quite a generic title. It’s not a surprise to see CFOs/Finance Directors have the least number of vacancies, as there are fewer of these positions available within companies, but we are still seeing a strong need for skilled finance leaders to navigate businesses through these challenging times ahead. CFOs are then followed by Finance Director, but there seems to be a lot of vacancies still from Financial/Management Accountant and Finance Manager/Controllers.

What we are seeing is an economic downturn, causing difficulties in companies’ ability to hire new staff and at times even keep existing employees. BUT senior finance employees are still a crucial part of the business during challenging times. Yes, there will still be redundancies and we are seeing that, so far we are seeing larger corporates making redundancies, but inevitably over time this will filter down to SMEs.

From a hiring perspective, we hear from many hiring managers that they are still struggling to attract and hire for their senior finance roles. Adverts don’t seem to be attracting the right candidates, and they are losing out to other, more competitive opportunities with the candidates they do manage to attract. The time to hire has greatly increased and it’s a frustrating time for hiring managers. Looking at our own data, 72% of the roles I have filled for clients this year have come from direct headhunting and referrals from my existing network and the remaining 28% coming from other channels (adverts, direct sourcing CVs from job boards).

What I’ve noticed this year is that senior finance candidates have been in such demand that their companies have given them promotions, pay increases and flexibility so most aren’t actively looking for a new role. Because of this, most candidates are not active on job boards or proactively applying to new roles. However, for the right opportunity they can be tempted into new positions and having the ability to headhunt and tap into the passive candidate network has been very important to be able to successfully hire this year. If as a hiring manager you don’t have the time or resources to do this; I would highly recommend engaging with an agency so you’re not missing out on the passive candidate talent pool.

Oh no not another budget update, I’ll keep this one brief as I’m sure a lot of you will have already seen the news. Let’s hope for no more u-turns though!

So just to re-cap on several changes that will impact employers and employees:

The unavoidable conclusion of these is that next year and beyond will be more expensive for everyone, that is certain. Companies will need to be extremely resilient and plan ahead, but it’s likely senior finance candidates will be needed now more than ever to support with cashflow management and cost saving projects.

Despite many big tech companies laying off thousands (Facebook, Twitter etc..) it’s not all bad in the tech market. I read an interesting report from Deloitte detailing the fastest growing 50 tech companies, which shows many tech companies are still doing well and scaling.

A few key highlights for me;

SaaS and Fintech are leading the way: Out of the top 50, 39 were from SaaS (27) and Fintech (12), interestingly Fintech has seen a slow down this year but SaaS remains a dominant area.

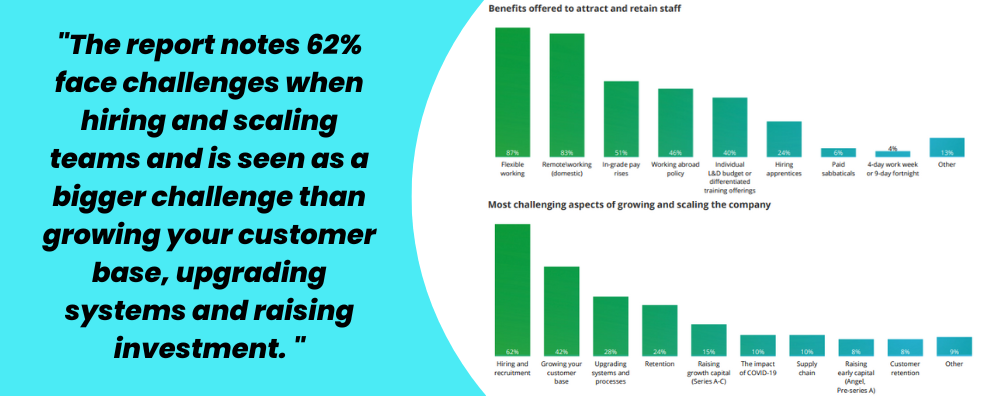

Hiring and recruitment is the biggest challenge: The report notes 62% face challenges when hiring and scaling teams and is seen as a bigger challenge than growing your customer base, upgrading systems and raising investment. I do wonder if raising investment will become a greater challenge as the market declines as does the appetite from investors.

Remote or flexible working key to attracting and retaining talent: The survey notes two thirds are struggling to attract talent, and 40% are struggling to retain talent. One option some have adopted is remote or flexible working. This could be hybrid working arrangements, flexi hours or complete remote working. A fifth of these start-ups have the option to work from anywhere in the world and implemented 4 day work weeks. What are your thoughts on this in finance? Could you see month end working with a 4 day week?

Investment appetite for 2023: 2021 saw the same amount of deals as 2019 but raised over 7 times the amount at £1.2b, so these top 50 start-ups really became attractive propositions for investors and again in the first half of 2022 they raised £688m. Even during economically challenging times, there is still investment out there for innovative companies but 2023 will prove difficult to convince VCs to part with their cash, so it’ll be important for start-ups to differentiate themselves.

One VC partner we work with said, they are looking to make less overall deals in 2023 but to actually invest more per company than in previous years to give these start-ups a longer run rate to see out the recession. We’ve also heard of investors re-investing in start-ups rather than new ones, including investment to fund acquisitions of competitors.

Still a strong demand for interims, but not as much as previously predicted

Several months ago, I predicted there would be a strong demand for interims next year and I still think this is likely to remain. During an economic downturn and uncertainty in the markets many companies will opt to hire an interim rather than permanent whilst assessing the market and how 2023 will pan out. The difficulty will now be attracting the interim talent. In my last prediction, I said I can see an influx of interims coming to the market due to the repeal on IR35 reforms. Well, now the repeal has been repealed (see previous update). I now don’t expect an influx of interims, so it will remain challenging to secure talent. Be prepared to pay a premium to secure a skilled senior finance interim in Q1 2023.

A continued demand for commercial finance/FP&A candidates

Again following my last predictions, I feel next year will see a demand for commercial finance/FP&A candidates. Planning budgets and forecasts, running scenario models and evaluating the impact on businesses from inflation to government budget announcements will have FP&A/commercial finance teams very busy over 2023. Not just in Q1, I see this being in demand across the next 12 months.

Cost saving and cashflow management is key

“Cash is king” as the saying goes, and if you’ve been reading my updates long enough you’ll remember during the pandemic I said “If cash is king, then cost saving is Queen”. As we head towards 2023, these have once again become the main priorities for CFOs. Candidates that can demonstrate skills in cash management, forecasting and leading cost-saving reductions will be highly valuable to companies (perhaps candidates that supported companies through 2020/21 for example).

A declining market, but a constant struggle for talent

The economy is expected to retract in 2023, with a 2-year recession on the cards. High inflation is also impacting businesses and employees. The job market is also expected to decline further, with redundancies and less companies hiring but we still have a long way to go before we hit the pre-pandemic levels.

Despite the predicted doom and gloom, the job market remains candidate driven. Companies are struggling to find and attract top talent and I don’t see this changing in Q1. Senior finance candidates are highly sought after in economic downturns, so even though markets may be declining the need for quality finance professionals to support businesses remains high.

This is the final update before Christmas, how has that come around so quickly? I’d like to thank everyone for continuing to read these updates and wish everyone a lovely time over the Christmas holidays. Look out for my next update in the new year! In the meantime, if you would like any advice on hiring, candidates, salary benchmarking or a general chat about the market or to discuss your next role; you can now book a 30-minute call with me here – https://calendly.com/ashley-absolute-recruit/30min