Welcome to April’s update 👋 A month of holidays and bank holidays, and from what I hear having back-to-back bank holiday weekends over month-end has not been ideal. We should really re-adjust our bank holidays and spread them throughout the year…BUT one that was rather important was the coronation of King Charles III! My favourite part was seeing Prince Louis pulling faces 😊

In recent years, we have seen the required skillsets of Finance Analysts moving closer to those of a Data Analyst, as companies are increasingly looking to hire a blend of the two skillsets. The finance industry has long relied on data-driven insights to make informed decisions, but now, with the rise of big data and advanced analytics, these two roles are starting to merge.

One of the key drivers behind this is the increasing use of technology in finance. As businesses seek to stay competitive, they are turning to data and analytics to gain a competitive edge, leading to an increased demand for finance professionals who have the skills to work with large data sets and extract insights from them.

As a result, we are seeing more and more finance analysts learning skills that were previously associated with data analysts. This includes programming languages like Python and SQL, as well as data visualization tools like Tableau and Power BI.

One of the main advantages of this, is that it allows finance professionals to be more self-sufficient when it comes to working with data. Instead of relying on IT teams or data analysts to extract insights from data, finance professionals can now do it themselves. This can lead to faster decision-making and a more agile business. Another advantage is that it can lead to more accurate insights. Data analysts and finance analysts bring different perspectives to data analysis, and by working together, they can identify patterns and insights that may have been missed if they were working in silos.

This is clearly evident speaking with our clients, who speak about the need to better understand and manage large data sets and it’s now common to see job adverts looking for Finance Analysts with prior SQL/Python/Power BI/Tableau experience. Candidates are noticing the change and are beginning to take courses, developing in these sought-after areas.

Did you know that 28% of companies report a positive ROI within a year of implementing a new ERP system? Another 58% within two years and another 15% within the third year!

Last month I discussed the rise of the ERP implementation for 2023 (march update), I talked about best practices to start and manage an implementation which has since prompted multiple conversations with clients speaking about the pitfalls around failed implementations, clearly this is still a hot topic so I’ve dug a little deeper into failed implementations.

Implementing an ERP system can be a daunting task, it can be a fine balance between success and failure. Get it right and the business can see an improved bottom line, increased process efficiencies and great collaboration across the business. But getting it wrong can be a timely and costly mistake to rectify. According to Deloitte, between 55% and 75% of ERP projects fail and this can lead to a headache for the team to fix, which can also negatively impact team moral as they work through a failed implementation fix.

EPC Group reported the top 3 reasons for a project failing;

Hiring a consultant to project manage the implementation can avoid these issues and ensure a smoother transition. Did you know 90% of companies implementing an ERP system use a consultant to support the implementation?

A recent example of this was a System Implementation Project Manager that we introduced to a client, who talked through the above issues with the client and worked closely with the business to understand the goals and pain points of the business. Setting clear objectives with the teams and defined a thorough implementation plan with champions in each team. The plan was then communicated to the whole team who were fully trained prior to implementation and testing phase, with adequate post-implementation support. Resulting in an engaged team and successful implementation, avoiding the common issues above and a happy client starting to reap the rewards of the new ERP system.

CFOs need to carefully vet potential consultants and ensure that they have a solid track record of successful ERP implementations, partnering with an agency can be beneficial as it can be difficult and time consuming to find specialists, whereas a specialist agency will be well placed to make recommendations. If you are looking at implementing Netsuite, Microsoft Dynamics, WorkDay or any other ERP, please get in touch.

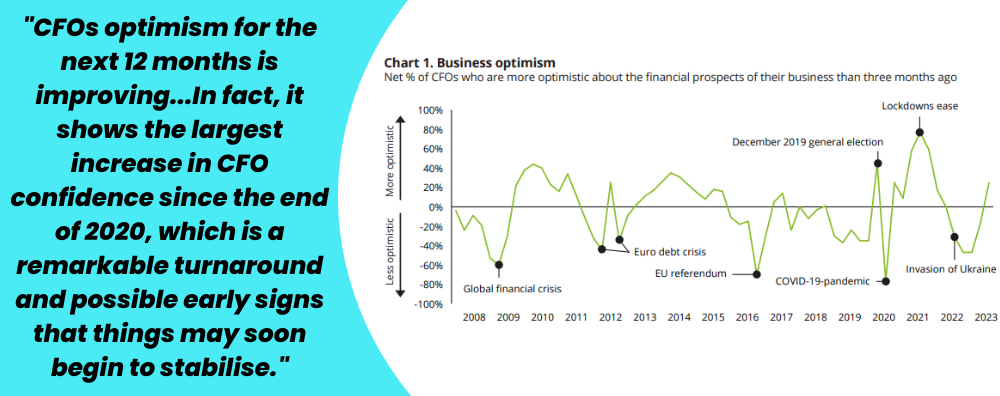

CFO optimism for the next 12 months is improving! In fact, Deloitte’s latest quarterly CFO survey reports that sentiment amongst CFOs has improved significantly since the start of the year. In fact, it shows the largest increase in CFO confidence since the end of 2020, which is a remarkable turnaround and possible early signs that things may soon begin to stabilise.

Despite the optimism, CFOs are still very much in defensive strategy mode, with the two main priorities being increasing cashflow and reducing costs. Many conversations this month with our CFO contacts have still largely been around driving costs down, improving efficiencies within the team and improving cashflow visibility and position.

CFOs also noted the main areas of risk for their businesses at the moment are;

The high inflation and rate rises have been instrumental in a change of candidates priorities shifting back to salary, whereas previously during 2020-2022 the main priority has been work-life balance and flexibility. That’s not to say these are no longer important, they still remain a high priority, but more and more candidates are leaving roles because they haven’t received a bonus or their salaries haven’t increased this year.

NetSuite implementation specialists

NetSuite is proving a highly popular system for our SME and scaling mid-sized clients this year. Our clients have been looking for Project Managers who can oversee the entire implementation, as well as Technical Implementation Specialists and Finance Managers with prior NetSuite experience to drive the implementation and map processes and support with the data migration.

Insurance Accountants

IFRS 17 implementations, underwriting accountants, syndicate accountants and more! If you are already working within a London-based insurance company and are looking to make a move or you’re working within one of the big four accounting firms in the insurance audit team, get in touch as we have roles at all levels.

ACA Newly Quals from practice

A part of the market that always seems to be in demand is newly qualified ACA’s looking to move out of practice and into their first industry role. 2023 looks set to continue the demand and we’ve introduced accountants into new roles including financial reporting and FP&A across SaaS, Tech, Real Estate and Retail! The increased demand for these candidates have pushed base salaries up by almost 20% over the last 3 years. If you’ve qualified within the last 18 months and are looking for a new industry role, please do get in touch!

Construction & Real Estate Accountants

Accountants with a background in Construction or Real Estate have been in high demand this year, with companies competing for top talent. Several clients have come to us after having a failed internal recruitment process. Construction companies who want candidates to be in the office 5 days per week have particularly struggled, but even companies offering flexibility have still found it challenging. If your internal job adverts are not reaping the results, our advice in this instance would be to partner with an agency who can tap into the passive candidate market.

Thank you for taking the time to read our senior finance market update. As always, if you would like any advice on hiring, candidates, salary benchmarking or a general chat about the market or to discuss your next role; you can now book a 30-minute call with me using this link – https://calendly.com/ashley-absolute-recruit/30min