Welcome to February everyone! January usually feels like the longest month, but for me, that flew by! Perhaps for the tax accountants it felt a little longer (well done to you all though, you’ve made it!). January was a month of train strikes, NHS strikes, teacher strikes, recession talk but it was also a month where many usually look for their next opportunity.

The positive signs are that so far, this year doesn’t look any different as we have seen an influx of the “new year new job” crew arriving on the scene to find their new dream job!

It’s not just the actively looking candidates that have increased in Jan – responses from our headhunting activities are also proving fruitful this month, with many passive candidates interested in hearing about what else is on the market.

If you’re considering hiring in your team soon, I would say now is the best time as I don’t expect many of these new-to-market candidates to hang around for long! If in doubt, talk to your friendly London senior finance recruiter (Me!)

Deloitte’s latest quarterly CFO survey paints a clear picture of the current state of the economy and its impact on day-to-day financial activities. Despite the downturn, many CFO’s are reporting that inflation risk is beginning to ease from its peak in October 2022 – and many expect inflation to fall to 5.8% by the end of the year and 3.3% by the end of 2024.

CFOs seem hopeful that this year will be slightly easier recruiting compared to 2022. However, almost a third are still reporting severe or significant recruitment difficulties. Although challenges in recruiting may be easing for some due to recruitment levels reducing and redundancies across certain sectors (big tech for example), we expect the demand for senior finance candidates isn’t slowing at the same pace as the overall market.

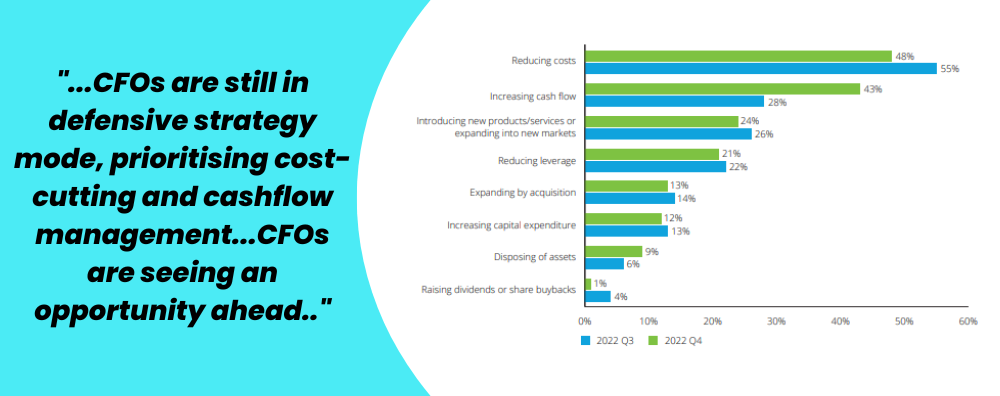

CFOs are still in defensive strategy mode, prioritising cost-cutting and cashflow management. One of the key areas we have been supporting clients with over the last 6+ months is hiring candidates with expertise in leading cost-cutting projects and others with strong cashflow management experience.

Despite the current difficulties, CFOs are seeing an opportunity to grow market share; 23% of CFOs noting a potential to acquire distressed or low-priced assets. As well as demand for finance professionals with strong cash management backgrounds to cut costs, another key area we’ve been supporting clients in is introducing candidates that can help with acquisition due diligence work and post-acquisition integration work.

The cost-of-living crisis is causing many to look at other opportunities that may better support them through potential economic hardships. Online job board, Total Jobs reported that 59% of workers stated that a pay rise that is at least in line with inflation is one of the most important factors in their job. 58% of employers were able to increase salaries over the last 12 months, but over a third of these pay rises were between 1-5% (meaning a drop in overall earnings when taking inflation into account!). 34% of the employers who raised salaries increase them by 5-10% and another 16% of companies gave payrises between 11-20%. Interesting to see, especially when compared to the fact that most senior finance candidates moving to new companies over the last 12 months have managed to secure between 10-20% increases.

On the flip side of this, knowing that 59% of candidates are looking at salary as one of the most important factors in their job search, it’s mind-boggling to see that employers are still not putting salaries on job adverts! Reed.co.uk reported 44% of employers have said they have never or only sometimes put the salary on job adverts. For companies looking to hire – this is a huge opportunity as the data shows a 27% increase in applications for adverts disclosing a salary!

I spoke to several of you last month about salary reviews and for anyone who hasn’t already taken me up on the opportunity from last month’s market update. I am still offering a free salary review for you and your finance team. Given what I have discussed above, it’s clearly a hot topic for employees and not something to be ignored.

UK vacancies have fallen further to 1.16m: down 11% from the 1.3m peak we saw in May 2022. While yes, the overall market is in decline, is it a decline or a readjustment from the redundancies and then post covid hiring? For my senior finance contacts reading this, after looking into data from Adzuna; it isn’t all bad news. Despite a dip in Q2 last year, since then senior finance vacancies have remained at similar levels.

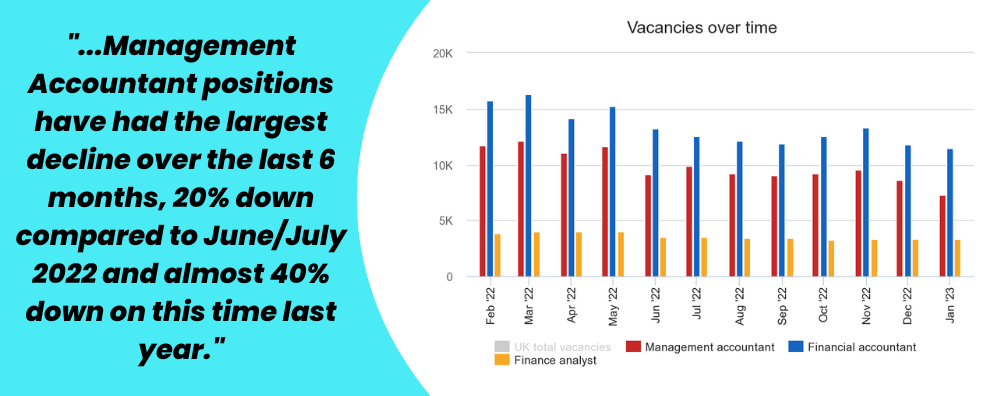

Management Accountant positions have had the largest decline over the last 6 months, with 20% less openings compared to June/July 2022 and almost 40% down on this time last year. Financial Accountant vacancies have held steady since the summer last year, but it’s worth noting that we often see Financial Accountant titled adverts with management accounts focussed duties. So if you’re searching for similar positions, I recommend searching for both titles and looking through the job description before applying.

Commercial finance vacancies have remained at very similar and stable level since June 2022, which is unsurprising considering the continued demand we’ve seen for candidates to support with budgeting, forecasting, analysis and project-led business partnering work. In my last update (click here) I predicted these candidates to be in demand for 2023 as companies continue to battle for top talent, and this has certainly been the case this past month.

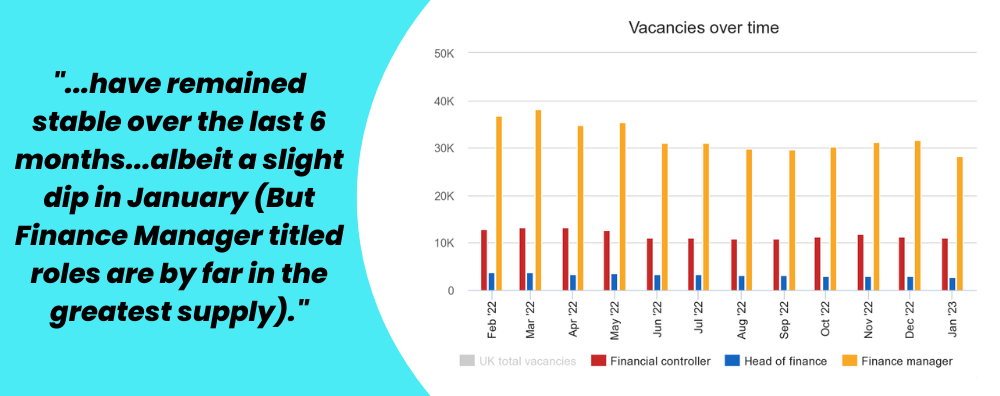

Financial Controller and Head of Finance positions have remained stable over the last 6 months. Finance Manager vacancies have too, despite a slight dip in this month (but Finance Manager titled roles are by far in the greatest supply). Finance Manager and Controller titles are widely used and can wildly range on salaries, so it’s always worth checking out the adverts and looking at the detail of the role.

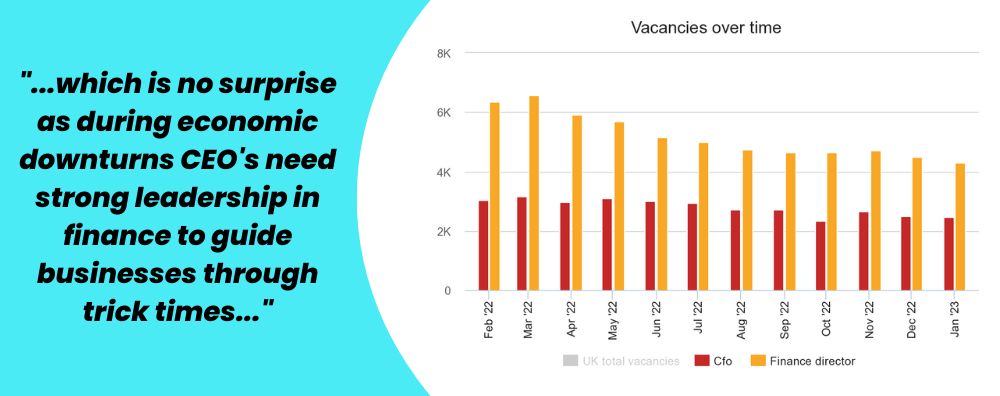

Since last summer Exec-level finance roles have remained fairly flat, which is no surprise as during economic downturns CEO’s need strong leadership in finance to guide businesses through tricky times; managing funding, strategic investments (acquisition opportunities) and cashflow management.

Cashflow management

As the Deloitte CFO report suggests, cashflow management is critical for businesses as they navigate 2023. Candidates skilled in cashflow reporting and management have been finding themselves with multiple opportunities and offers from clients. Candidates able to demonstrate tangible results and explain what they implemented and how it changed the business will have great opportunities at securing pay increases in new roles.

M&A

Another area the Deloitte report mentioned was CFO’s reporting an increase in the opportunity to acquire businesses in this downturn. I’ve already supported clients looking to do the same, introducing candidates who have previously supported with M&A activity from senior-level finance professionals capable of managing the whole acquisition process to financial modellers to provide projections and due diligence work as well as candidates with experience in supporting the post-acquisition integration process. I can see a lot of consolidation in certain markets in 2023 and where competitors will be buying out their smaller struggling rivals, which will mean good news for candidates with M&A experience!

SaaS

One of the most dominant areas of start/scale-ups, and certainly one to watch this year is SaaS. As companies look to reduce costs, increase cashflow and streamline operations, many SaaS applications that are suited to this market will certainly be considered as a worthwhile investment. Senior finance candidates with experience in SaaS start/scale-ups have been and will continue to be sought after. Candidates with recurring revenue recognition experience, SaaS modelling and candidates that have built board packs with SaaS metrics will be in hot demand!

AI

An area we are seeing huge growth and appetite in and a lot of exciting AI tech coming onto the market. Take Chat GPT for example, an AI-driven chat bot that has been hyped up to take on and potentially replace Google! It was the fastest company ever to acquire it’s first 1 million users (in just 5 days) and has been tipped to be the fastest company to hit £100m ARR! Candidates already working in the tech start-up space will have great opportunities coming up to utilise their prior skills in new up and coming AI start-ups!

Thank you for taking the time to read our senior finance market update. As always, if you would like any advice on hiring, candidates, salary benchmarking or a general chat about the market or to discuss your next role; you can now book a 30-minute call with me using this link – https://calendly.com/ashley-absolute-recruit/30min